Rejoice, O young man, in your youth, and let your heart cheer you in the days of your youth. Walk in the ways of your heart and the sight of your eyes. But know that for all these things God will bring you into judgment.

Ecclesiastes 11:9

This verse comes as a surprise after chapters full of “Thou shalt not’s” and “All is vanity”. It’s a rare (but not unique) biblical exhortation to go out and have fun. Enjoy God’s bounty while you can. I’ve often responded with this verse when young Christians online bemoan the ubiquity of irresistible temptations (and their terror of hell) or when old Christians rail against ‘sin’. They forget that God wants us to have fun as long as we’re responsible. Follow your heart. Carnal delights are part of God’s kingdom, and always will be (though the manifestation will change greatly with AI and robots).

I’d expected that the young Christians would be relieved by this message. But much to my chagrin, they usually attack me for promoting sin among the impressionable (a transgression deserving of drowning by millstone, as they are quick to reproach me). They respond much more favorably to the shibboleth that “True faith in Jesus curbs all temptation” – and with the help of an ‘accountability partner’ you will overcome your urges to curse, gamble, drink, masturbate and gay sex. Alternately, by reciting “Jesus, Jesus” like a mantra, you will earn your get-out-of-hell-free card to play on judgment day. “Everyone’s a sinner, including you,” they scold. Of course, but that doesn’t mean we can’t improve:

You therefore must be perfect, as your heavenly Father is perfect.

Matthew 5:48

The fact is, they are the faithless ones and will die in their sin.

These misconceptions arise from Paul’s letters to the leaders of the new church around the world. His censure was directed at the excesses and abuses by the clergy. However the clergy now weaponizes his reprimands against the naive and impressionable of the flock, condemning them to eternal torment for youthful diversions and healthy sexual behavior. They get a kick out of pretending to be chaste as they engage in all the conduct they forbid. Their agenda is to make people despise Christian doctrine to create apostates and atheists to battle at Armageddon (and in the meantime, to exploit the vulnerable for labor and sex). This litany of hypocrisies condemns the modern church to the hell it inflicted on the least of these, just as Jesus execrated the fatuous Hebrew priesthood of his time:

“But woe to you, scribes and Pharisees, hypocrites! For you shut the kingdom of heaven in people’s faces. For you neither enter yourselves nor allow those who would enter to go in.”

Matthew 23:13

Of course, there are limits to self-indulgence. The verse warns of God’s judgment for irresponsible behavior (for example, blaming your indiscretions on alcohol or drugs). Atheists bristle at such strictures, challenging the right of anyone to judge them just for being human (especially the guy who made them that way). The word ‘judgment’ in a religious context is synonymous with condemnation. But it also entails the converse: salvation. The fact is, this verse is liberating, because it says: don’t fear judgment by a world of idiots. Focus instead on earning God’s approval.

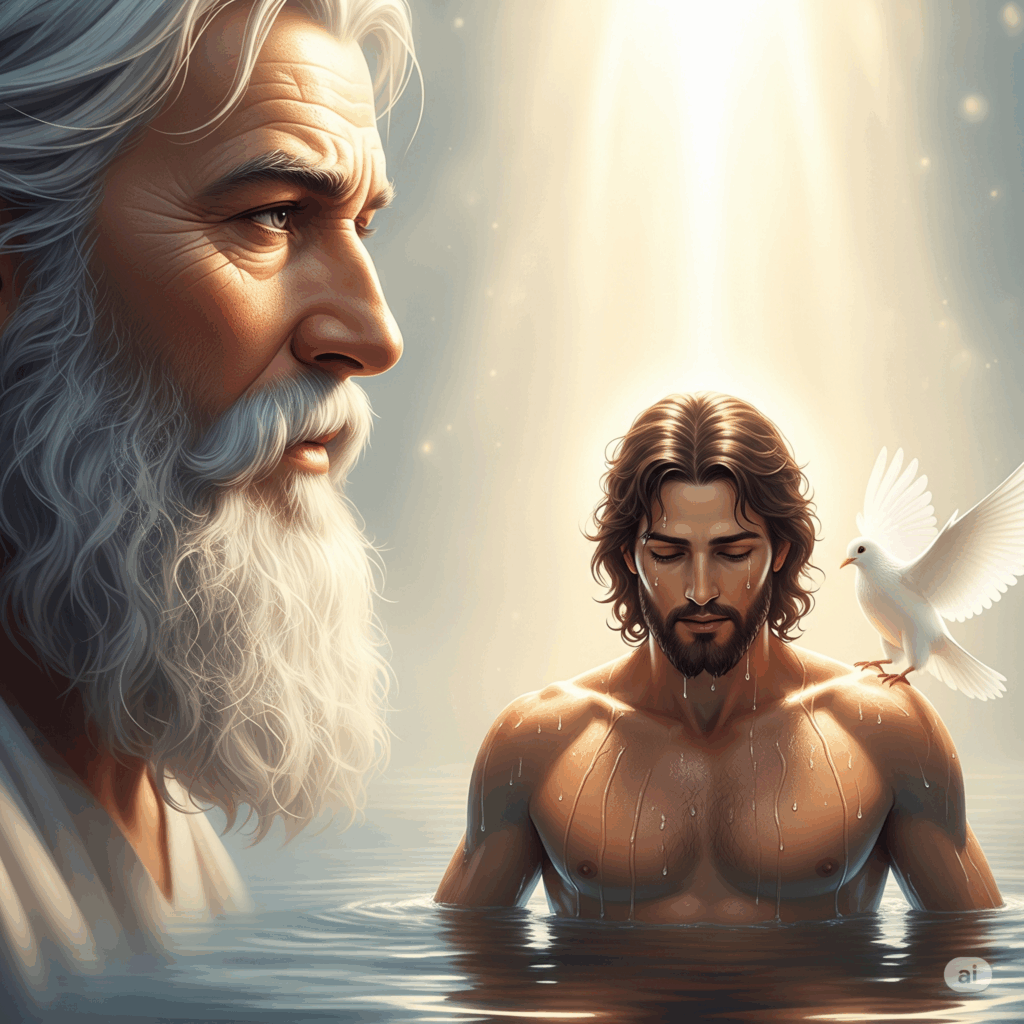

So how do you know that God is proud of you? Because he will proclaim it! Nearly two thousand years ago (AD 28), Jesus was baptized by his cousin John in preparation to launch his ministry:

And behold, a voice from heaven said, “This is my beloved Son, with whom I am well pleased.”

Matthew 3:17

Jesus is fully God. But he’s also completely human. No doubt He had fun as a young man. But those days were over. Now at age 30, it was time to put his youthful (and gay) escapades behind him. He had a world to save.

If God has been silent since Jesus’s death, it is only because no one has met His approval – no one – not even Thomas Jefferson or Albert Einstein. (Einstein famously promoted the abomination of Zionism – he was greedy for acceptance by the cabal inflaming antisemitism hysteria.) Despite all our successes and achievements, which fuel an epidemic of delusion of grandeur, none is righteous. We are still living as we did 3000 years ago:

In those days there was no king in Israel. Everyone did what was right in his own eyes.

Judges 17:6

Now the new world is upon us. Everyone is proud of himself, certain of his moral probity, desperate for inclusion, and none fear God. This is a sure sign that the Messiah’s return is imminent. Who will be the modern scion of God’s pride? The prophets augur that she will be the last person that anyone – including our highly revered experts – ever expected:

The stone that the builders rejected has become the cornerstone.

Psalm 118:22

She will be the first of many perfect children of God:

“Take my yoke upon you, and learn from me, for I am gentle and lowly in heart, and you will find rest for your souls. For my yoke is easy, and my burden is light.”

Matthew 11:29

If being Christian is hard, you’re doing it wrong.